Inflation for P&C Insurers: Managing Risks to Both Sides of the Balance Sheet

March 14, 2022

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.” - Ronald Reagan

By Matt Reilly, Managing Director, Institutional Solutions and Yazeed Abu-Sa’a, Director, Institutional Solutions

The increase in inflation - 7% in 2021 - has captured many headlines and market expectations suggest inflation rates are likely to remain higher over the near term. The U.S. Federal Reserve and others are working at containing the aforementioned menace of inflation to which Reagan referred. In the meantime, for property and casualty (P&C) insurers, building strategies to counter this concern requires an understanding of the magnitude of the inflation they are dealing with and the potential impact on both sides of their balance sheets, a complex task Conning thinks can be aided significantly through risk modeling.

Insurers can be hurt in many ways by inflation. Inflation impacts the real (adjusted for inflation) values of the portfolio, income and returns. The impact on liabilities can be more complex, and it can have greater effect on insurers with longer tail risk.

As inflation is not a static event, analysis is complex and the impact on individual insurers will be dependent on company-specific factors. Conning believes modeling of the various possibilities is critical to help insurers better develop strategies to manage inflationary risk, both at the investment-portfolio and enterprise level.

Inflation Impact on Insurance Operations

To better understand the impact of inflation on liabilities, it may help to separate the impact into those for current and future losses and the impact on prior losses and reserves.

In higher inflationary environments, expenses for insurance operations and claims increase more than expected, resulting in lower income in the current period. This can be mitigated somewhat as insurance carriers reprice their policies for higher expenses and claims costs. For prior losses, both known and unknown, insurance companies carry reserves and as future prices rise, the amount reserved for these losses might be inadequate. This could result in a decrease in redundant reserves or, in worse cases, require additional reserves for prior period losses.

The liability impacts are further compounded by the types of risks insurers are covering, so for simplicity’s sake, we segment P&C insurers into two buckets: short-tail lines, such as personal lines, and longer-tail lines, such as workers compensation, medical professional liability and other liability coverage.

For personal lines, such as personal auto, claims are known and estimated relatively accurately in a short period of time. The payouts on these claims also tend to be shorter in duration, resulting in lower risk to underestimating reserves for losses. Liability lines have longer payout periods, sometimes extending decades, and might not be known or settled for years after they occur. The increased length of payouts and uncertainty over future claims exposes the business to meaningfully higher risk of underestimating current claims, and in an inflationary environment these impacts can be exacerbated.

Inflation will affect different business lines in different ways. Using personal automobile as an example for a short-tail insurance, the business will be sensitive to inflation in the future costs of vehicles and as well as medical costs resulting from injuries. Workers’ compensation insurance, as a proxy for a long-tail line of business, will not be as sensitive to the changing prices of automobiles but will be impacted by changes in wages, medical expenses and other related costs.

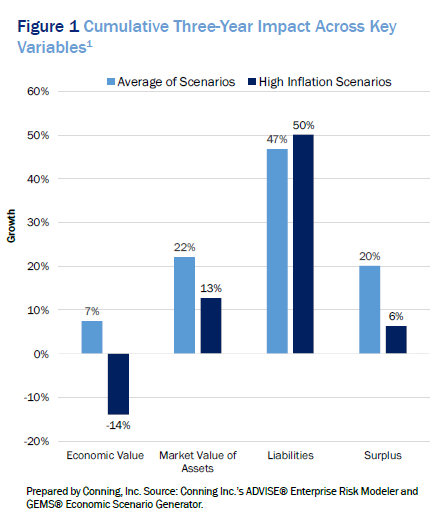

Bringing together the possible risks of the asset side and the liability side, insurance carriers can experience meaningfully adverse consequences to enterprise metrics such as net income, surplus or value.

Click below to continue reading Conning’s Viewpoint, “Inflation for P&C Insurers: Managing Risks to Both Sides of the Balance Sheet."

Disclosures

Past performance is not a guarantee of future results. These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise. ©2022 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Advisors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. ADVISE®, FIRM®, and GEMS® are registered trademarks in the U.S. of Conning, Inc. Copyright 1990-2022 Conning, Inc. All rights reserved. ADVISE®, FIRM®, and GEMS® are proprietary software published and owned by Conning, Inc. C: 14588084A