The Long Game of Inflation – Dynamic Portfolio Strategies

May 09, 2024

By Yazeed Abu-Sa’a, FCAS, MAAA, Managing Director, Insurance Solutions

Inflation is a complex phenomenon, its roots intertwined in various economic, political, and global factors. This presents unique challenges and opportunities for the investment strategies of insurance companies.

Insurers are still navigating from a terrain marked by prolonged low investment rates and squeezed margins to an unpredictable inflationary environment and balance sheets holding large unrealized losses. This paper explores how insurers can adapt their investment strategies to hedge against uncertainties caused by inflation and extended periods of higher interest rates, exploring avenues such as real estate, equities and specialty products, while also incorporating strategic asset allocation and risk management best practices. Conning believes applying more dynamic investment strategies may also benefit insurers over the long term for most economic conditions.

The Impact of Inflation and the Outlook for Interest Rates

Our March 2022 Viewpoint studied the impact of inflation on insurance companies’ financial statements, observing deviations between actual results and projections due to deteriorations in assets and liabilities. We highlighted the extended influence of inflation and some companies’ constraints in implementing protective measures. We also discussed the limited flexibility that many investment portfolios have in dealing with these challenges amid regulatory and rating agency scrutiny. Ultimately, we determined that a thorough portfolio assessment and strategic planning can significantly mitigate these concerns.

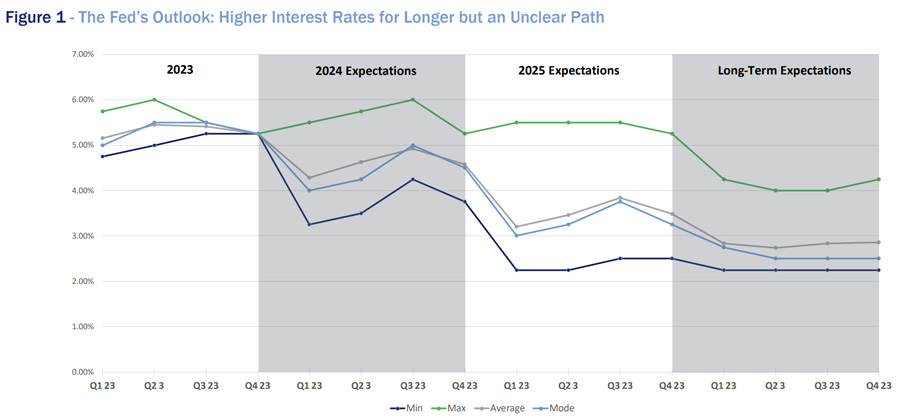

Reflecting on 2023, the Federal funds rate ended the year at 5.33%. Despite the U.S. Federal Reserve’s declaration to halt the cycle of increases, the outlook for the next two years remains uncertain (see Figure 1) but there is a strong inclination toward keeping rates higher for an extended period.

Although the exact timing and sequence of policy adjustments remains uncertain, the implications of maintaining higher interest rates for an extended period are multifaceted. These are positives for insurance companies: sustained higher rates present a unique opportunity to recalibrate pricing strategies, innovate by launching new products, and transition their investment portfolios toward higher yielding investments.

However, higher rates could also lead to elevated borrowing costs for the economy overall, prompting a pullback in business investment and expansion, potentially ushering in a phase of economic deceleration. (The real estate sector’s responses remain uncertain, marking an area of keen interest for observers.) Moreover, the capacity of financial companies to manage

unrealized losses hinges on their ability to maintain sufficient liquidity and any disruption in the capital market or broader economy could lead to pre-mature rate cuts, which may initially invigorate growth but also carry the risk of renewing inflationary pressures.

Click below to continue reading Conning’s Viewpoint, “The Long Game of Inflation – Dynamic Portfolio Strategies."

Disclosure

©2024 Conning, Inc. This document is copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning. Conning does not make any warranties, express or implied, in this document. In no event shall Conning be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice. This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning for investment advisory services. The information in this document

is not intended to be nor should it be used as investment advice. COD00000035