Dividend Equity Strategies: Managing Higher Volatility, Rising Interest Rates and Inflation

June 22, 2022

“Do you know the only thing that gives me pleasure? It’s to see my dividends come in.” – John D. Rockefeller, 1908

By Donald Townswick, Director of Equity Strategies

It’s 2022 and inflation, geopolitical instability, rising interest rates and more are driving uncertainty to heights not reached since the late 1970s. Meanwhile, economic growth is falling and market volatility is at its highest levels since the onset of the pandemic. In the wake of this, many insurance companies have begun to reevaluate their equity investments. Is it time for them to follow John Rockefeller’s example and focus on dividend-paying equities?

When compared to an index equity strategy such as the S&P 500 Index commonly found in many insurance company portfolios, a dividend-paying equity strategy may offer insurers lower volatility, income opportunities and potential tax advantages. It may also prove to be a more effective equity strategy during a period of rising interest rates when viewed from a duration perspective.

A History of Lower Downside Risk

Historically, insurance companies have been reluctant to invest in equities, preferring fixed income securities’ typically higher yields and lower volatility. More recently, the need for portfolio growth led companies to take on equity exposure, often via passive index funds. Insurers became more willing to accept the higher volatility and lower income of equities in return for their potential capital appreciation. Unfortunately, they also accepted that they would only be able to convert the value of their equities into cash by selling shares, thereby triggering a taxable event.

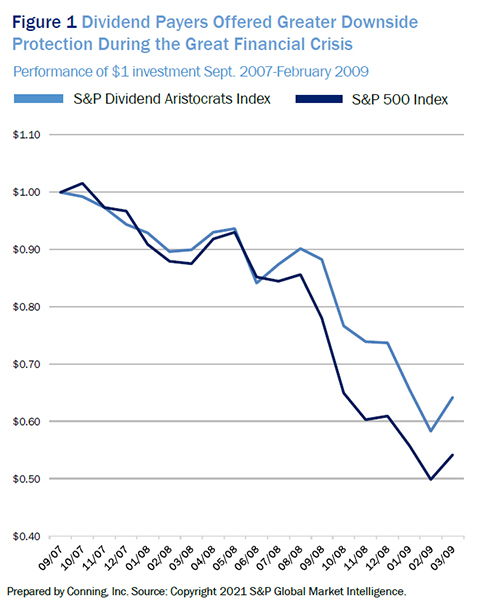

The Great Financial Crisis (GFC) of 2008-2009 caused many insurance companies and asset managers to again adjust their approach to equity investing. During the GFC, insurance companies experienced the downside of passive investing: when the market falls, passive investments bear the full brunt of the downturn. Lost to many in the chaos of the time was the fact that dividend-paying stocks did not drop nearly as much during this period as the broader market (as Figure 1 illustrates, the decline of dividend-paying stocks was only about 80% of the broader equity market between September 2007 and February 2009).

In fact, dividend-paying stocks have outperformed in other downturns as well, notably after the tech bubble burst in 2001.

After the GFC caused interest rates to drop and equity yields to rise, insurance companies began to look for an equity investment solution that combined higher yields with lower volatility. Many turned to dividend-paying stocks.

Click below to continue reading Conning’s Viewpoint, “Dividend Equity Strategies: Managing Higher Volatility, Rising Interest Rates and Inflation."

Risks of Dividend-Paying Stocks for Insurers

Equity prices will decline in bear markets. Potential changes in dividend tax rates could lessen demand for the asset class. A sharp increase in interest rates could affect prices of income-oriented equities.

Disclosures

All investment performance information included in this document is historical. Past performance is not a guarantee of future results. Any tax-related information contained in this document is for informational purposes only and should not be considered tax advice. You should consult a tax professional with any questions. ©2022 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. C: 15182345