High-Dividend Equities: A Focus on Upside Participation with Downside Protection at Reasonable Valuations

May 09, 2025

Sunny Wadhwa spoke with Andy Pace and Don Townswick about the current state of the equity market and why they think the firm’s high-dividend equity strategy is ideal for insurance portfolios.

What is causing current market volatility?

Don (DT): President Trump’s April 2 “Liberation Day” introduction of new tariffs certainly led to a spike in volatility, but there has been a great deal of uncertainty gripping markets for some time now.

With this much uncertainty, it is no surprise that equities are volatile and that they may remain so for an extended period.

Will equity market conditions change? What do you think will happen?

DT: Markets are always changing, and this market will as well. As we study the current dynamics, we actually see a silver lining in the outlook for dividend-equity stocks.

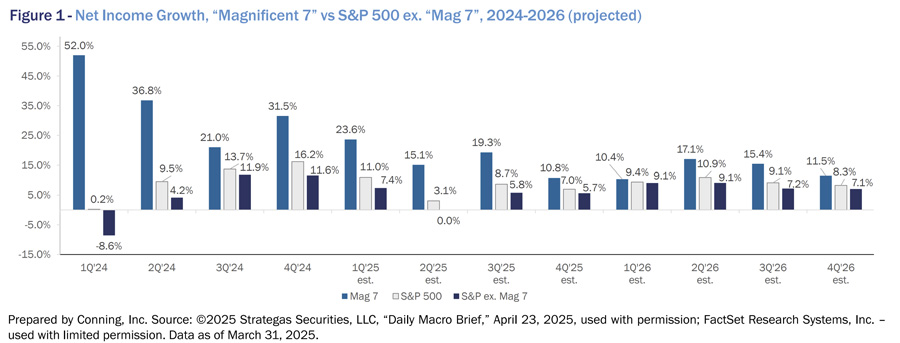

The stocks recently dominating S&P 500 Index performance have been in a narrow band known as the “Magnificent 7” stocks: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. Most other stocks in the index have been performance laggards. In Figure 1, we compare the recent and projected quarterly net income of the “Magnificent 7” versus the rest of the S&P 500. The outstanding earnings (which are closely related to net income) performance of the former has begun to taper and is projected to settle into a lower range, while earnings for the rest of the stocks in the index are projected to rise through the rest of 2025.

DT: As most of our clients are insurance companies and tend to be fairly risk-averse equity investors, they are holding their allocations; we are not seeing wholesale buying or selling.

However, in many client conversations we’ve noted that a large number see this “tariff induced” selloff as a buying opportunity, once the acute uncertainty abates. Our clients have a very long horizon for their equity investments and equities are usually the longest duration asset they own. They often look to add during market dips or in situations like we are currently in, and like us, many clients believe the current selloff is overdone. The broadening of the market away from the “Magnificent 7” stocks has certainly been welcomed by our clients after two years of a small number of stocks driving the majority of the market’s returns.

Andy (AP): NAIC and state regulatory requirements limit insurance portfolio allocations to equity and while most insurers don’t like surplus volatility, they do understand the need to have an equity allocation in order to grow surplus. Conning’s recommended approach in recent years has been an allocation to our lower-volatility, higher-dividend strategy.

AP: Initially what led us to develop this strategy was the period of historically low interest rates post-Great Financial Crisis: we saw the equities of many high-quality companies offering dividend yields that exceeded the yields of their long-term debt. The dividend income, plus the potential for growth, as well as the lower beta (historical beta of 0.82 to the S&P 500) and higher quality approach (average NRSRO credit rating of the holdings of A), made a strong case for insurers to consider an allocation to this strategy, either solely or as a complement to their existing equity allocations.

Lastly, dividends have contributed a meaningful share of the total return of equities over long time horizons and, in periods of uncertainty or volatility, provide a stabilizing element to performance.

Tell us about the process: How do you build the portfolio?

AP: Our goal is to create a diversified portfolio of companies with strong balance sheets and free cash flow, that have higher dividend yields than the S&P 500, a history of stable payouts and dividend growth, and potential for capital appreciation.

Our rules-based method of building the portfolio has been the same since inception, repeated in the last month of each quarter and based upon a disciplined three-step process (quantitative screening, qualitative review, and finally name selection) designed to filter the universe of potential investment candidates from the S&P 500. So not only is this a low-volatility, high-quality, value-oriented approach, it is also a low-turnover/cost approach, as we only trade on a quarterly basis.

AP: In addition to the higher dividend income, insurers have also benefitted from the strategy’s strong historical risk-adjusted return, which since inception has provided upside market capture of 90% of the S&P 500’s gains; the downside protection has been evident with a downside market capture of only 82% of the index’s declines.

Historically, the strategy has performed best when equity markets are experiencing volatility, such as we’ve seen this spring. Our clients have found having a higher-quality, larger-capitalization, lower-volatility portfolio quite valuable during periods of market uncertainty.

Are there other benefits?

ABOUT CONNING

Conning (www.conning.com) is a leading investment management firm with a long history of serving insurance companies and other institutional investors. Conning supports clients with investment solutions, risk modeling software, and industry research. Founded in 1912, Conning has investment centers in Asia, Europe

and North America. Conning is part of the Generali Group.

Disclosures

©2025 Conning, Inc. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, and Conning Asia Pacific Limited (collectively “Conning”) and Octagon Credit Investors, LLC, Global Evolution Holding ApS and its subsidiaries, and Pearlmark Real Estate, L.L.C. and its subsidiaries (collectively “Affiliates” and together with Conning, “Conning & Affiliates”) are all direct or indirect subsidiaries of Conning Holdings Limited which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning & Affiliates. Conning & Affiliates do not make any warranties, express or implied, in this document. In no event shall any Conning & Affiliates company be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice.

Conning, Inc., Conning Investment Products, Inc., Goodwin Capital Advisers, Inc., Octagon Credit Investors, LLC, Global Evolution USA, LLC, and PREP Investment Advisers, L.L.C. are registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940, as amended, and have noticed other jurisdictions they are conducting securities advisory business when required by law. In any other jurisdictions where they have not provided notice and are not exempt or excluded from those laws, they cannot transact business as an investment adviser and may not be able to respond to individual inquiries if the response could potentially lead to a transaction in securities. SEC registration does not carry any official endorsement or indication that the adviser has attained a level of skill or ability.

This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning & Affiliates for investment advisory services. The information in this document is not intended to be nor should it be used as investment advice.

Copyright 1990-2025 Conning, Inc. All rights reserved.

COD00001145