Equities Watch: Views on Value Stocks, Dividends and Tax Policy

July 27, 2021

Conning’s Head of Consultant Relations, David Motill, caught up with Don Townswick, Conning’s Director of Equity Strategies, to learn more about the firm’s outlook for equities, including the importance of dividend-paying stocks and other lessons learned in the past few years.

- David: At the end of 2020, we saw a rotation from growth to value within U.S. equities. What is your view on how value stocks will perform for the remainder of 2021?

Don: In relative terms, value stocks look poised to perform well relative to growth stocks and we have a couple of reasons supporting that view.

One is that growth stocks tend to outperform when economic growth is weak or scarce, which is contrary to what a lot of people think. Historically, growth stocks do well when growth is scarce because there is more demand for, and less supply of, such stocks. Unfortunately, environments of low growth are not that good for value stocks which tend to be slower revenue growers even though they are good at generating free cash flow, something that we really focus on.

We have been in a period of low growth for a while, but are experiencing much better growth in 2021. This is positive for value stocks because it broadens the market, giving more stocks the opportunity to do well and allowing investors to look further for attractive stocks. With renewed near-term growth and with Conning forecasting strong economic growth in 2022 and 2023, we believe this makes value stocks relatively attractive.

A second reason we expect value to outperform for the foreseeable future is that, from a valuation perspective, value stocks currently are even less expensive relative to growth stocks than they are typically. That furthers our belief that value stocks will outperform for the rest of the year.

- How have dividend-paying stocks historically contributed to equity portfolio growth?

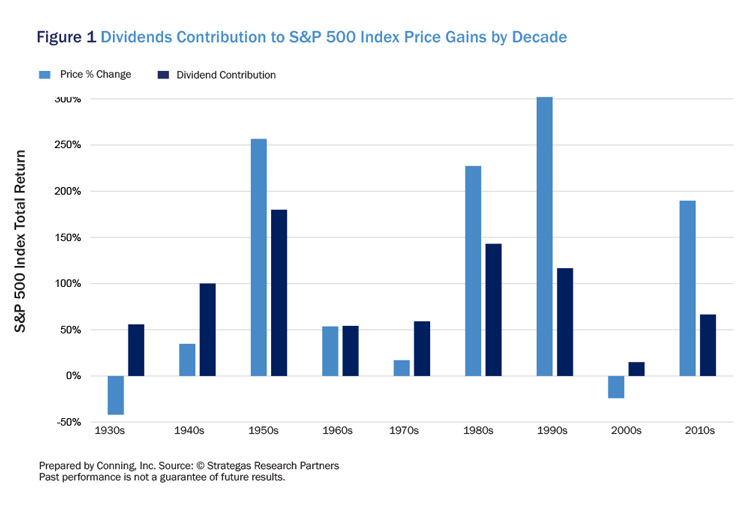

Dividend-paying stocks have contributed a large percentage of portfolio growth in the modern era going all the way back to the 1930s (see Figure 1).

One of the reasons is that mature companies tend to generate consistent free cash flow, but their business decisions are not single-mindedly focused on reinvesting in their business. Good, solid dividend-payers that return value to shareholders while executing their business tend to make for attractive stocks in the long run. Growth stocks appreciate in value, especially with new technology and markets opening up, but eventually those businesses mature, and that growth rate is no longer available. Successful companies over the longer term understand how to operate effectively in both higher- and lower-growth environments. Sometimes, reinvesting in the business when you do not have any growth prospects is not the best use of capital.

- How do we expect dividend-paying stocks to perform given the Biden administration’s proposed fiscal policies?

We believe that dividend-paying stocks, which are generally mature companies, will continue to do well but the proposed policies from the Biden administration bear watching.

If corporate tax rates are expected to rise back to the levels that we saw prior to the tax cuts made a few years ago, that would get our attention because dividends are paid with earnings after taxes. In theory, any fiscal moves that could impact company earnings may affect the ability of companies to increase their dividends, and we focus on investing in companies that increase their dividends over time in the Conning High Dividend Equity strategy.

- How does Conning incorporate ESG factors into the High Dividend Equity strategy investment process?

Conning has been a PRI signatory since 2012, and we have incorporated ESG factors into both our equity and fixed income investment processes.

We have a three-step investment process for the High Dividend Equity strategy. The first step is a quantitative screen of the S&P 500 index to identify stocks that meet our criteria of minimum dividend yield, dividend history, leverage, free cash flow and credit ratings.

The second step is a qualitative screen where the companies that have passed the initial quantitative screen are analyzed by our credit analysts, and this is where our ESG expertise is put to use. Our credit analysts incorporate Conning’s proprietary ESG factors in fundamental, bottom-up analysis and assign a strong, average or weak rating to each name. If a company has a weak ESG rating, it is unlikely that our credit analysts will recommend it to our investment team.

The third and final step involves our investment team reviewing the companies that have passed the second step and constructing the portfolio before each quarterly rebalance, based on comparative analysis and diversification requirements.

Donald Townswick, CFA is Director of Equity Strategies, responsible for the development and implementation of equity investment strategies and is a member of the team managing Conning’s dividend equity strategies. Prior to joining Conning in 2015, he was senior portfolio manager for global equity strategies at Golden Capital Management. Previously, he was director of quantitative research for ING, and a U.S. equities portfolio manager with INVESCO and Aetna. Mr. Townswick earned a BS in mechanical engineering from the University of Southern California and an MBA from Vanderbilt University.

David D. Motill is a Managing Director and Head of Consultant Relations at Conning. Prior to joining the firm in 2010, Mr. Motill was a partner and chief marketing officer at Alpha Equity Management. He previously headed consultant relations groups with Fischer Francis Trees & Watts, Citigroup Asset Management and GE Asset Management. Mr. Motill earned a degree from Temple University and an MBA from the University of Notre Dame and holds Series 7 and 63 licenses.

ABOUT CONNING

Conning (www.conning.com) is a leading investment management firm with a long history of serving the insurance industry. Conning supports institutional investors, including insurers and pension plans, with investment solutions, risk modeling software, and industry research. Founded in 1912, Conning has investment centers in Asia, Europe and North America.

Disclosures

Past performance is not a guarantee of future results.

These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the In- vestment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.

©2021 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guar- anteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice.

Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Advisors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company.

C: 13112092A