Funding Agreements: Strategic Capital for a New Insurance Era

August 20, 2025

By John Rup, Director - Insurance Solutions

The individual annuity market has recently captured the attention of life insurers due to a wave of demographic tailwinds, rising interest rates and record-breaking sales growth and many carriers are deploying significant resources to this highly competitive, capital-intensive space. Yet a lesser publicized – but equally powerful – opportunity exists in the form of funding agreements.

Broadly speaking, funding agreements are a contract for an insurer to accept and accumulate funds and make one or more payments at future dates that are not dependent on mortality or morbidity risks, but on the terms of the contract itself. While strict definitions may vary by state, funding agreements may be classified under deposit-type contracts and are typically purchased by an institutional investor base.

Funding agreements can provide insurers access to an ocean of stable, reinvestment-driven capital, potentially on more favorable and operational terms than traditional retail liabilities. They offer the benefits of 1) diversifying their issuance channels, 2) more predictable liabilities and 3) a high degree of funding flexibility.

Diversifying Issuance Channels

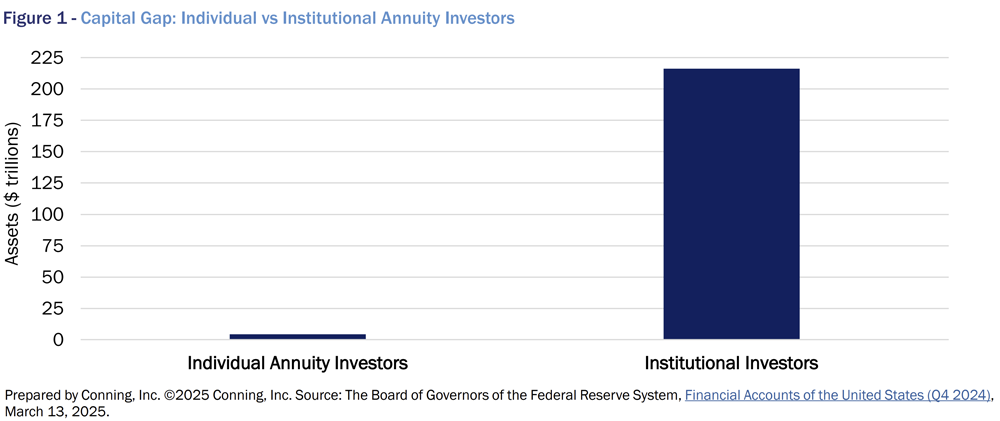

While the individual annuity market continues to expand with households increasingly allocating retirement assets into annuity-like products, the scale of this retail opportunity remains modest compared to the capital available in institutional markets.

As illustrated in Figure 1, at year-end 2024, households with annuity-like retirement investments totaled approximately $4.3 trillion1. By contrast, the institutional investor universe, including mutual funds, pensions funds, insurance companies and sovereigns, holds more than $200 trillion in assets – 50 times larger than households – offering a vastly larger pool of capital with continuous reinvestment needs.

Funding agreements offer insurers a pathway to tap into this deep, liquid market by positioning themselves as high-quality, yield-generating counterparties.

Click below to continue reading Conning’s Viewpoint, “Funding Agreements: Strategic Capital for a New Insurance Era."

Footnotes

1. “Individual Annuity Investors” equate to assets from life insurance general and separate accounts pension entitlements including reserve credit from reinsurers. “Institutional Investors” equate to private, state and local pension entitlements, private depository institutions, property-casualty and life insurers, money-market funds, mutual funds, closed-end funds, exchange-traded funds, finance companies, broker-dealers, holding companies and other financial businesses.

©2025 Conning, Inc. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, and Conning Asia Pacific Limited (collectively “Conning”) and Octagon Credit Investors, LLC, Global Evolution Holding ApS and its subsidiaries, and Pearlmark Real Estate, L.L.C. and its subsidiaries (collectively “Affiliates” and together with Conning, “Conning & Affiliates”) are all direct or indirect subsidiaries of Conning Holdings Limited which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning & Affiliates. Conning & Affiliates do not make any warranties, express or implied, in this document. In no event shall any Conning & Affiliates company be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice.

This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning & Affiliates for investment advisory services. The information in this document is not intended to be nor should it be used as investment advice.

Copyright 1990-2025 Conning, Inc. All rights reserved.

Additional Source Information

This Conning publication uses data sourced from Copyright 2025, S&P Global Market Intelligence LLC. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements of opinions and are not statements of fact.

COD00001518