The FHLB Assist: Helping Insurers Liquidity Options to Boost Balance-Sheet Strength and Financial Stability

June 26, 2025

By John Rup, Director, lnsurance Solutions

In today’s volatile financial landscape, insurers are quietly getting creative. With interest rates in a higher-for-longer regime, credit spreads tightening, and liquidity under pressure, many are looking beyond the traditional playbook. Capital markets may not always be open when needed, and utilizing alternative liquidity sources can be costly when navigating unstable conditions.

Enter the Federal Home Loan Bank (FHLB) system – a nearly century-old network of regional banks whose mission is to provide liquidity to their members to support housing finance and community development through all economic cycles. FHLB membership may be a valuable benefit for insurers as its borrowing programs may help enhance profitability, balance-sheet strength and financial stability. FHLB membership is growing among larger insurers and Conning believes it merits further consideration from mid-size companies as well.

The FHLB system was founded in 1932 in response to the Great Depression to support homeownership and distressed lenders. Insurers can also use the FHLB system and its competitive borrowing rates for emergency short-term liquidity backstops, funding for working capital or strategic investments (including mergers and acquisitions), aid in asset-liability management, or pursuing additional net investment income through spread-investing programs.

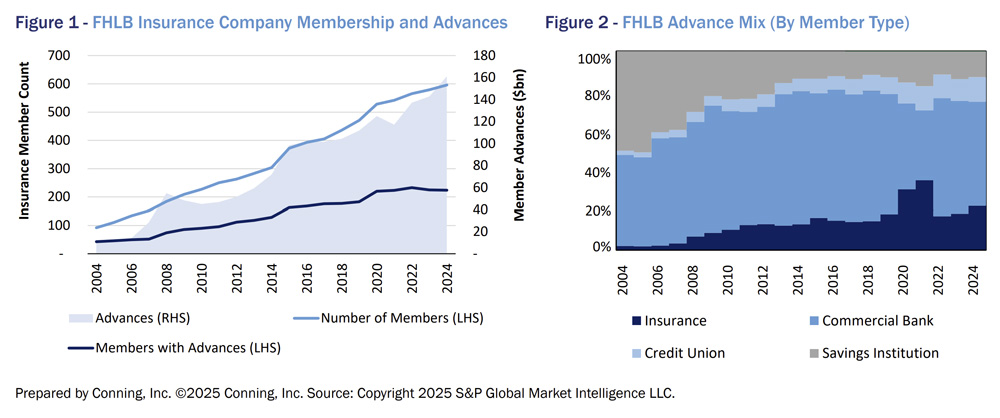

A growing number of insurance companies are looking to take advantage of FHLB programs, as witnessed by the increasing membership rate and borrowing activities (see Figure 1). At year-end 2024, 596 insurance companies were FHLB members, up from 579 in 2023; outstanding loans, or “advances,” to insurers rose to $161 billion from $143 billion, despite roughly the same number of insurers borrowing.

Click below to continue reading Conning’s Viewpoint, “The FHLB Assist: Helping Insurers Liquidity Options to Boost Balance-Sheet Strength and Financial Stability."

Legal Disclaimer

©2025 Conning, Inc. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, and Conning Asia Pacific Limited (collectively “Conning”) and Octagon Credit Investors, LLC, Global Evolution Holding ApS and its subsidiaries, and Pearlmark Real Estate, L.L.C. and its subsidiaries (collectively “Affiliates” and together with Conning, “Conning & Affiliates”) are all direct or indirect subsidiaries of Conning Holdings Limited which is one of the family of companies whose controlling shareholder is Generali Investments Holding S.p.A. (“GIH”) a company headquartered in Italy. Assicurazioni Generali S.p.A. is the ultimate controlling parent of all GIH subsidiaries. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning & Affiliates. Conning & Affiliates do not make any warranties, express or implied, in this document. In no event shall any Conning & Affiliates company be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice. This document is for informational purposes only and should not be interpreted as an offer to sell, or a solicitation or recommendation of an offer to buy any security, product or service, or retain Conning & Affiliates for investment advisory services. The information in this document is not intended to be nor should it be used as investment advice. Copyright 1990-2025 Conning, Inc. All rights reserved.

Additional Source Information

This Conning publication uses data sourced from Copyright 2025, S&P Global Market Intelligence LLC. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security,does not address the suitability of an investment or security and should not be relied on as investment advice. Credit ratings are statements ofopinions and are not statements of fact.

COD00001306