Equity Investing for Insurers: Keeping Steady on the Till in Rough Seas

August 01, 2022

“A smooth sea never made a skilled sailor.” - Old English Proverb

By Matt Reilly, Managing Director, Institutional Solutions

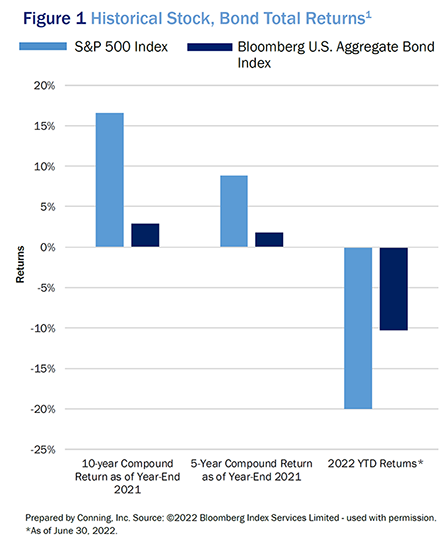

Equity markets had been smooth sailing for investors over the past decade with the S&P 500 Index returning 16.9% a year through 2021. However, as investors are learning in the beginning of 2022, these returns are not without risk. With the unwinding of pandemic-driven fiscal and monetary policy accommodation, levels of inflation not seen in decades, and heightened volatility from geopolitical shocks, choppiness has returned to the seas of financial markets.

As long-term investors, insurance companies face a unique challenge. Growth assets, stocks in particular, have played a key role in meaningful surplus growth amid meager reinvestment rates in predominantly fixed income portfolios. While yields are improving, real returns from fixed income are expected to be poor. Insurers need to decide what to do with their portfolio of growth assets amid increasing uncertainty.

Conning has reviewed recent equity performance, examined divergent asset allocations pursued by insurers, and proposes some analytical frameworks to help insurers keep a steady approach to investment strategy. Despite current equity market conditions, we remain convinced that many insurers would benefit from exposure to stocks and other growth assets over the long term and a number should consider expanding their equity holdings.

A Rising Market Squall

During the past decade equity investors regularly witnessed double-digit gains in equities with few exceptions. However, in 2022 the S&P 500 was down 20% through June (see Figure 1). Making the situation worse, the usual ballast of fixed income was also down due to higher interest rates and wider spreads in credit markets: the Bloomberg U.S. Aggregate index returned -10.3% through June 2022 (see Figure 1).

Recent historical equity drawdowns were more harsh: the S&P 500 fell 38% in the early part of 2020 due to the pandemic and was down 54% in less than a year amid the 2007-2008 financial crisis.2 With that in mind, insurers allocating to equities need to be mindful that the next bout

of choppy market performance may be on the horizon.

For insurers, these precipitous declines are exacerbated as balance sheets are typically leveraged (more dollars of investments than surplus) and equities are marked to market on balance sheets. An insurer with a 2-to-1 ratio of investments to surplus and a 10% allocation to equities would have lost 2.6% of surplus with the drawdown through June 2022. While this risk to hard-earned surplus and the fast-rising market volatility are far from ideal, these risks need to be reconciled with the higher returns equities could potentially deliver over the long term.

Click below to continue reading Conning’s Viewpoint, “Equity Investing for Insurers: Keeping Steady on the Till in Rough Seas."

Risks

Market, or systematic, risk is the risk that individual stock returns may be correlated with general market downturns regardless of the particular business conditions and outlook for the individual stocks. Inflation erodes the purchasing power of future cash flows from investments. In times of high inflation the value of securities may be reduced. Liquidity risk can occur when market conditions do not allow transactions to be made in a quick and orderly fashion in relation to indicative market prices.

Disclosures

Past performance is not a guarantee of future results. These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise. The efficient frontier was created using Conning’s GEMS® Economic Scenario Generator. Projections of future values are based on forward-looking assumptions about investment performance and insurance results developed by Conning. Although our assumptions are based on information from reliable sources, we do not guarantee their accuracy or completeness. Assumptions are based in part on historical economic, investment and insurance market data. Past performance may not be indicative of future results. Therefore, no one should assume that the future performance of any specific investment, investment strategy or product, or any insurance company, composite or line of business, made reference to directly or indirectly, will necessarily resemble the indicated performance levels in our models. Model output and recommended investment strategies and portfolios are used to illustrate Conning’s approach to insurance asset management. These were developed using publicly available data. It is not intended that any recommendations be implemented without preparing an updated strategic asset allocation analysis, incorporating private company information. ©2022 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. ADVISE®, FIRM®, and GEMS® are registered trademarks in the U.S. of Conning, Inc. Copyright 1990-2022 Conning, Inc. All rights reserved. ADVISE®, FIRM®, and GEMS® are proprietary software published and owned by Conning, Inc