Energy Markets 2050: Alternatives Growing Fast but Hydrocarbons Retain Dominance

September 19, 2023

By Conning's Commodities Investment Research Team

Despite heightened concerns regarding fossil-fuel emissions and climate change, global demand for hydrocarbons is expected to rise. They will likely remain the dominant energy resource in a world that expects energy demand to increase for several decades.

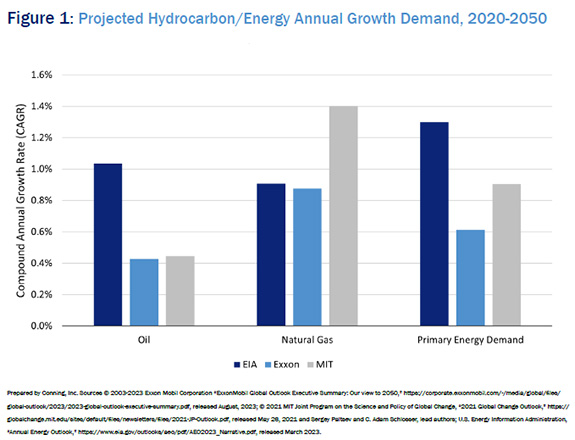

Recent projections by three different organizations – energy producer Exxon Mobil Corporation (Exxon), the U.S. Energy Information Administration (EIA) and the Massachusetts Institute of Technology (MIT) – agree on the global demand growth for hydrocarbons (see Figure 1).1 Demand is rising due to an expected growth in global energy consumption of at least 0.9% per year on average through 2050, driven by a 2.7% compound annual growth rate (CAGR) in GDP.2

All three reports project oil consumption will increase but natural gas consumption should outpace it, driven largely by growth in the global liquified natural gas export market and support of the U.S. electricity grid. However, the growth outlook for coal remains mixed. Non-hydro renewables (biomass, geothermal, solar, and wind) will also likely see strong growth as analysts have become significantly more bullish on the category than they were less than a decade ago: renewables have a projected CAGR of 4.5% and are now expected to comprise about 23% of primary energy consumption by 2050, compared to just 2.6% in 2015.3

But regardless of the energy source, the future is likely to see a significant increase in energy infrastructure to support the growing need to transport and store these sources of energy.

Electric vehicles (EVs) are becoming more efficient, and their growth should lead to reduced automobile-based oil demand – but greater electricity demand. This demand shift, along with a continued electrification of the economy, is projected to drive a greater need for natural gas relative to oil as the former is the electrical grid’s leading energy source. Non-OECD countries, mainly emerging market economies, should also help drive hydrocarbon growth as rising energy demand will be part of their efforts to improve living standards as GDP rises. The rising demand will also likely lead to greater investments in hydrocarbon-related infrastructure.

Click below to continue reading Conning’s Viewpoint, “Energy Markets 2050: Alternatives Growing Fast but Hydrocarbons Retain Dominance."

Footnotes

1: Sources: © 2003-2023 Exxon Mobil Corporation “ExxonMobil Global Outlook Executive Summary: Our view to 2050,” https://corporate.exxonmobil.com/-/media/global/files/global-outlook/2023/2023-global-outlook-executive-summary.pdf, released August, 2023 (“Exxon Report”); © 2021 MIT Joint Program on the Science and Policy of Global Change, “2021 Global Change Outlook,” https://globalchange.mit.edu/sites/default/files/newsletters/files/2021-JP-Outlook.pdf, released May 26, 2021, Sergey Paltsev and C. Adam Schlosser, lead authors (the “MIT report”); U.S. Energy Information Administration, “Annual Energy Outlook,” https://www.eia.gov/outlooks/aeo/pdf/AEO2023_Narrative.pdf, released March 2023 (the “EIA report”).

2: Energy-demand growth is average of 2020-2050 energy-demand CAGR listed in the Exxon, MIT and EIA reports; global GDP CAGR is average of 2020-2050 GDP CAGR in the Exon, MIT, and EIA reports.

3: Renewables CAGR and expected consumption percentage are averages of the Exxon, MIT and EIA reports; 2015 consumption percentage is per Conning, “Energy Markets 2040: Alternatives Have Growing Cachet but Hydrocarbons Still Rule the Day,” by Marcus McGregor, Eric Gallic, and Matthew Nilson, January 2018, https://go.conning.com/rs/461-JPO-444/images/Viewpoint%20-%20Energy%20Markets%202040.pdf

Disclosure

©2023 Conning, Inc. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning. Conning does not make any warranties, express or implied, in this document. In no event shall Conning be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice. This opinion is published by Conning, Inc., and represents the opinion of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice or a solicitation.

These materials contain forward-looking statements. Readers should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results . Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Research Team or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.

Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, Global Evolution Holding ApS and its group of companies, and Pearlmark Real Estate, L.L.C. are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. For complete details regarding Conning and its services, you should refer to our Form ADV Part 2, which may be obtained by calling us. C: 17380569