The Conning Commentary: A Foundation Ready for Growth in 2023

December 13, 2022

As 2023 begins, we find that individual and business consumers are facing a higher-risk world. The economy has been battered by inflation and the efforts to tame it. Volatile equity markets have reduced individual retirement and investment accounts along with company valuations. At the same time, employment has remained strong, contributing to the war for talent, even as the threat of recession looms ahead.

Beyond the economic picture, the rise of cyber-crime, natural catastrophes, and concerns about outliving retirement savings have made consumers more aware of the need to find protection.

Given this backdrop, it may seem that any insurance industry outlook for 2023 would be gloomy. Yet, as we look at the macro-environment, we see a foundation for strong growth in the property-casualty, life-annuity, and health insurance sectors.

In this look-ahead Commentary, we identify the key pieces of that foundation and why we think they indicate strong growth in 2023. We also give an overview of our 2023 forecast for all three insurance sectors. Next month, we will take a close look at each sector and what growth might look like for each of the major statutory product lines.

It’s (almost) about the economy

As we head into 2023, the possibility of a recession looms over the economy. A decline in real estate prices, an inverted yield curve, high inflation, and high-profile layoffs have all helped to increase this possibility. Despite this, however, our baseline is for economic growth, albeit slower than previously forecast. If a recession were to occur, it would likely be short and shallow.

The outlook for GDP (gross domestic product) growth and continued strong levels of employment are positive for premium growth in both the property-casualty and life-annuity sectors. Inflation is increasing expenses, but also is enabling property-casualty insurers to take rate. Higher interest rates are, finally, bringing some relief to life-annuity insurers, which have struggled to find yield during a prolonged low interest rate environment.

GDP outlook supporting P&C exposure growth

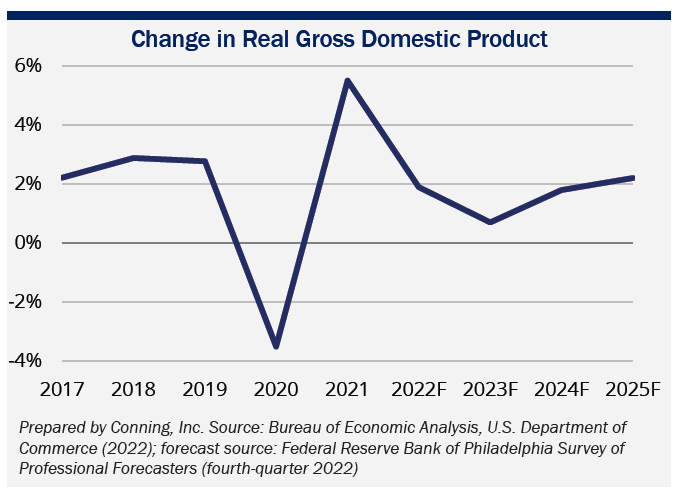

The growth in real GDP is a key part of the foundation for property-casualty exposure growth leading to higher premiums. Looking at 2023, we anticipate real GDP growth that is modest, at best.

Supporting that view is the Federal Reserve Bank of Philadelphia’s 2022 fourth-quarter Survey of Professional Forecasters. Their estimate for annual GDP growth is 0.7%, down from the previous quarter’s survey of 1.3%.1 Much of this growth is expected in the second half of the year. There is some worry for a potential downturn in real GDP in the first half of 2023. For the first two quarters of 2023, the Philadelphia Federal Reserve Bank Survey of Professional Forecasters predicts an almost 50% chance of a contraction, decreasing for the second two quarters of the year.1

As we head into 2023, we look at the most recent GDP report from October 2022. Real GDP increased on a quarter-by-quarter basis at 2.6%, or 1.8% on an annual basis, in the third quarter of 2022, driven in part by increases in exports, consumer spending, and federal and state government spending.2

Strong employment positive for premium growth

Looking next at the employment market, we expect to see a slower increase in payrolls as we head into 2023. Strong employment supports continued premium growth in all group benefits. In addition, employment enables individuals to purchase insurance and retirement products.

The Federal Reserve Bank of Philadelphia’s fourth-quarter 2022 Survey of Professional Forecasters lowered its 2023 monthly payrolls projection from 167,600 per month in the third-quarter projections to 143,600.1

While still positive, we project that the unemployment rate will increase slightly as the number of individuals looking for work increases. This was seen in the October 2022 jobs report. The unemployment rate increased from 3.5% in September to 3.7% in October as the number of individuals looking for work increased, despite payrolls increasing 261,000 for the month. Looking at 2023, the Philadelphia Federal Reserve’s fourth-quarter 2022 Survey of Professional Forecasters projects an unemployment rate of 4.2% in 2023, up slightly from the prior quarter’s forecast of 3.9%.1

Wage increases also continue to be a positive factor within the labor market. Per the Bureau of Labor Statistics, total private average hourly earnings continue to increase, beginning the year at $31.56 in January and increasing to $32.58 in October, a 3.2% increase year-to-date. Since January 2021, average hourly earnings have increased 8.9% through October 2022.3 Should the economy remain strong, we would anticipate that wages will continue to increase. Supporting that outlook is that several groups have already projected potential wage increases in 2023 of 4% or higher.4,5

Click below to continue reading "The Conning Commentary: A Foundation Ready for Growth in 2023."

Footnotes:

1. Federal Reserve Bank of Philadelphia, “Fourth Quarter 2022 Survey of Professional Forecasters,” November 14, 2022, https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q4-2022

2. Bureau of Economic Analysis, U.S. Department of Commerce (2022), “Gross Domestic Product, Third Quarter 2022 (Advance Estimate)” news release, October 27, 2022

3. Bureau of Labor Statistics, U.S. Department of Labor, https://www.bls.gov/news.release/empsit.nr0.htm

4. Copyright 2022 SHRM (Society for Human Resource Management), “Average US Pay Increase Projected to Hit 4.6% in 2023,” November 29, 2022, https://www.shrm.org/resourcesandtools/hr-topics/compensation/pages/us-pay-increase-forecast-for-2023.aspx

5. Copyright 2022 The Conference Board, Inc., “2023 Salary Increase Budgets Projected to Be the Highest Since 2001,” September 20, 2022, https://www.conference-board.org/blog/labor-markets/2023-US-Salary-Increase-Budgets

Disclosure

©2022 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice.

Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning (www.conning.com) is a leading investment management firm with a long history of serving the insurance industry. Conning supports institutional investors, including insurers and pension plans, with investment solutions, risk modeling software, and industry research. Founded in 1912, Conning has investment centers in Asia, Europe, and North America. C# 16107010