Course Correction: As investment environment becomes “risk off,” insurers revisit portfolio strategies

June 28, 2022

By Rich Sega, Global Chief Investment Strategist

For years the insurance industry has dealt with margin pressure from low interest rates, leading to income-seeking, risk-bearing approaches that have worked well in a non-inflationary, strong corporate earnings environment. However, the experiences of the past year signal that a change, perhaps even a reversal, of some of those strategies is underway.

A Decade of Financial Repression

Insurers have faced many disruptors to the business and investment strategies that supported them since the so-called Great Recession ended in 2009. During that time, insurance portfolios were under pressure to produce the income and contribute to the margins necessary to support the companies’ financial strength and meet obligations to policyholders.

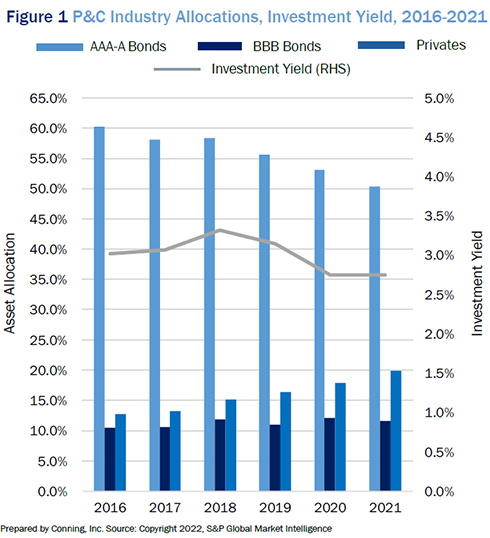

Chronically low interest rates and changing consumer preferences gradually pushed insurers’ allocations away from long-favored high-grade corporate bonds and government securities. Modern insurance portfolios for the most part tend to be far more diversified, although corporate credit still dominates. Insurers have gone lower in credit quality, longer on the duration spectrum, and down in available liquidity.

In the life industry, the challenge has been greater for the smaller and mid-sized firms, which comprise most of Conning’s client base. We have helped many life companies diversify into less traditional asset classes, but their larger peers appear further along. Those smaller insurers have been making everincreasing allocations to corporate bonds rated BBB but are having difficulty keeping up.

Overall, these actions have barely held insurers’ portfolio earnings rates on an even keel as valuations have climbed and market rates fallen.

Click below to continue reading Conning’s Viewpoint, “Course Correction: As investment environment becomes “risk off,” insurers revisit portfolio strategies."

Disclosure

©2022 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is in- tended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. All investment performance information included in this document is historical. Past performance is not a guarantee of future results. These materials contain forward-looking statements. Readers should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.