Rising Convertible Issuance May Aid Insurers Concerned with Inflation, Interest Rate Increases

September 27, 2021

By David Tyson, Ph.D., CFA, Managing Director and Portfolio Manager

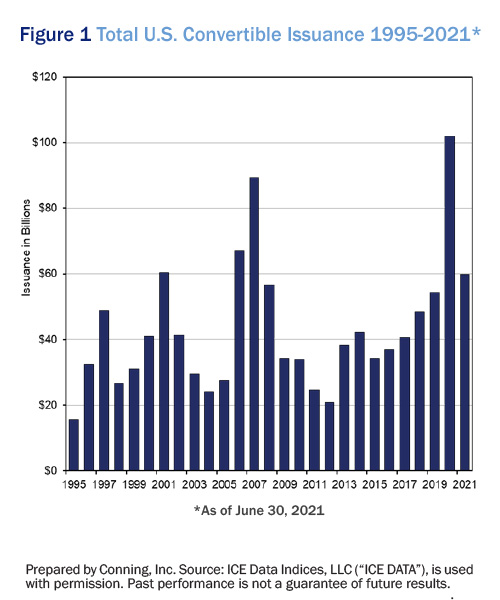

Convertible bonds’ record issuance (see Figure 1) is a timely resurgence in an asset class that may help insurers concerned with inflation and potential interest rate hikes.

An asset once more prominent in insurance portfolios over a decade ago, convertible bonds are designed to offer insurers the upside potential of equities - the securities can be converted into the common stock of the issuer - with the downside protection of a bond. Their bond-like risk-based capital (RBC) charges make convertibles an efficient tool to aid capital growth, a valuable feature should current inflation prove to be more than transitory. Convertibles may also help insurers hedge against a potential rise in interest rates rise that could affect fixed income portfolios.

Convertible issuance fell considerably following the 2008 financial crisis, especially among investment-grade companies, in part because declining interest rates made bonds a less expensive vehicle for most corporate financing needs. However, convertible issuance has spiked recently due to financing needs from newer companies, for which convertibles are a typical first issuance after an initial public offering (IPO), as well as from established companies raising equity to preserve ratings and financial flexibility.

Insurers considering this asset class may want to ensure they have the necessary expertise. Evaluating convertibles in terms of their relative bond and equity values and in determining their fit for an insurer’s portfolio is essential to considerations of this asset class.

Opportunities for Insurers

While U.S. corporate bond issuance steadily increased during the past decade to nearly $2.3 trillion outstanding in 2020,1 corporate equity and convertible issuance has been relatively flat. As Figure 1 illustrates, annual convertible issuance only surpassed $60 billion twice since 2000 before it reached $100 billion in 2020; Conning thinks issuance could reach $100 billion again in 2021.

Convertible issuance tends to correlate with equity issuance. While the number of U.S. public firms fell precipitously to some 4,300 in 2019 from the peak of almost 8,100 in 1996,2 more new companies are going public: 2020’s 209 IPOs was a significant increase over the average since 2015.3 Newer companies often issue convertibles after their IPO because they are challenged to get a high enough rating to issue a normal public bond. In addition, many new companies are growing rapidly and investors want a chance to participate in the upside. Established companies issue convertibles seeking to raise equity for other purposes like preserving ratings, building liquidity, or financing an acquisition. Convertible issues are generally at least $500 million, similar to corporate bond levels. Liquidity in convertibles tends to track that of the equity markets and convertibles are often more liquid than corporate bonds in difficult markets.

Click below to continue reading Conning’s Viewpoint, “Rising Convertible Issuance May Aid Insurers Concerned with Inflation, Interest Rate Increases."

Footnotes:

1 Source: © 2021 Securities Industry and Financial Markets Association (SIFMA), “US Fixed Income Securities: Issuance, Trading Volume, Outstanding,” as of Aug. 9, 2021. Used with permission

2 Source: The World Bank, World Federation of Exchanges database, “List of domestic companies, total – United States,” as of July 31, 2021 https://data.worldbank.org/indicator/CM.MKT.LDOM.NO?locations=US

3 Source: ©2001 SIFMA, “Capital Markets Fact Book 2021,” July 2021, table “US Equity Issuance – Number of Issues.” Used with permission.

Risks of Investing in Convertible Bonds

Equity market declines which reduces the value of convertibles’ equity conversion features.

A high level of corporate defaults or a sharp widening in corporate bond spreads which reduces the value of convertibles’ fixed income floors.

Low supply of issues due to prolonged low interest rates and strong demand for investment grade corporate and high yield debt.

Disclosure

©2021 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Advisors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. C# 13548203