CLOs: Helping Insurers Manage Duration Risk Amid Rising Interest Rates

June 01, 2022

By Paul Norris, Head of Structured Products, Conning

Gretchen Lam, CFA, Senior Portfolio Manager, Octagon Credit Investors

In response to the inflation spike that began in the latter half of 2021, the U.S. Federal Reserve (the Fed) is expected to continue to raise interest rates over the course of 2022 and 2023. Rising rates can present a challenge for insurance company portfolios that typically allocate a significant portion to fixed income securities. However, floating-rate debt instruments (i.e., those with coupons that increase as market interest rates rise) may help mitigate interest duration risk in diversified fixed income portfolios. Herein, we highlight one such floating-rate debt strategy: collateralized loan obligation (CLO) securities, also known as CLO debt tranches.

What is a CLO?

A CLO is a securitization backed by a diversified portfolio of senior secured floating-rate loans (also known as broadly syndicated loans or bank loans) that is financed using proceeds from the issuance of debt and equity securities. CLO debt obligations are divided into rated classes of notes, or tranches, typically ranging in rating quality/seniority from AAA to BB based on prioritization of interest and principal payment. The combined rated notes typically represent 90% of the CLO structure and CLO equity represents the remaining 10%. The broadly syndicated loans comprising a CLO’s collateral portfolio are rated below investment grade, generally senior to other outstanding debt within a company’s capital structure, secured by the assets of the borrowers, and bear a floating-rate coupon tied to an industry benchmark interest rate that adjusts periodically.

Competitive Risk-Adjusted Returns

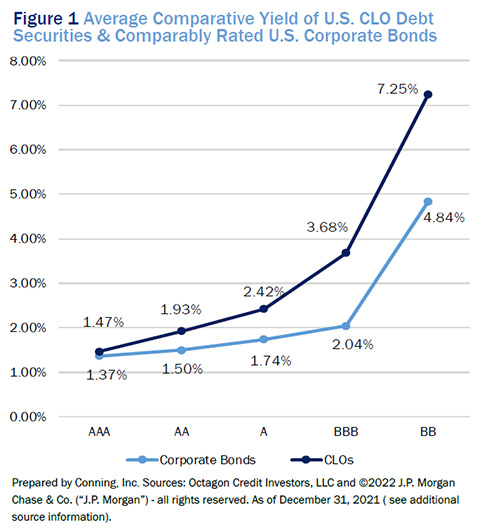

CLOs have gained attention from insurers and other institutional investors owing to their competitive yields and the proven resilience of the CLO structure over multiple credit cycles. As illustrated in Figure 1, CLO debt securities currently offer higher yields compared to other types of fixed income securities of similar quality, reflecting the relative complexity, lower liquidity, and regulatory requirements of CLOs. In the nearly 30-year history of the asset class, there has never been a default among a CLO tranche rated AAA or AA. Furthermore, the long-term historical default rate of 0.1% among A-rated tranches supports our view that investment grade CLO debt securities are “risk remote.” Compelling yields and comparatively low historical default rates for CLO debt tranches suggest that CLO tranche investors have generally been well compensated for the assumed risk. CLO securities may also offer diversification benefits to an insurer’s broader investment portfolio. As Figure 2 demonstrates, CLO securities have a reduced or negative correlation to assets commonly held in insurance portfolios.

Click below to continue reading Conning’s Viewpoint, “CLOs: Helping Insurers Manage Duration Risk Amid Rising Interest Rates."

CLO Risks Factors

Risk factors include but are not limited to the below; for further discussion of material risks, please refer to Conning’s Form ADV Part 2A.

Structure: CLOs often involve risks that differ from those associated with other types of debt instruments. The complex structure of the security may produce unexpected investment results not based on default or recovery statistics. Ratings agencies may downgrade their original ratings of CLO debt tranches. Majority equity holders retain the right to call or refinance/reprice a CLO, creating cash flow variability for minority equity and debt holders.

Liquidity: CLOs may be difficult to value and may constitute illiquid investments. Valuation of structured credit products are provided by third parties, based on models, indicative quotes, and estimates of value, in addition to historical trades. There is inherent difficulty in valuing these assets, and there can be no assurances the assets can be disposed of or liquidated at the valuations established, or that published returns will be achieved.

Default: During periods of economic uncertainty and recession, the incidence of modifications and restructurings of investments may increase, resulting in impairments to the underlying asset value and reduced “subordination” to the CLO liabilities.

Regulatory: CLOs are susceptible to changing regulations, influencing eligibility of certain investments, risk retention requirements, and other factors that can influence availability and liquidity.

LIBOR: CLO debt and bank syndicated loans historically used LIBOR as an interest rate benchmark, which is currently being phased out, with new instruments being issued with an alternative rate and all existing instruments tied to LIBOR required to transition by June 30, 2023. Replacement of LIBOR could adversely affect the market value or liquidity of CLO securities and/or loans, and pose tangential risk for markets and assets that do not rely directly on LIBOR. On July 29, 2021, the Alternative Reference Rates Committee formally recommended CME Group’s forward-looking Term SOFR rate as the replacement rate for U.S. dollar LIBOR, however, there is uncertainty with respect to replacement of LIBOR with proposed alternative reference rates, and it is possible that different markets might adopt different rates, resulting in multiple rates at the same time and a potential mismatch between CLO securities and underlying collateral, the effects of which are uncertain at this time, and could include increased volatility or illiquidity. In addition, operational and technology challenges during the transition from LIBOR as well as inconsistent communication from issuers could result in delayed investment analyses and reduced investment opportunities.

General Market and Economic Conditions: Changing economic, political, regulatory or market conditions, interest rates, general levels of economic activity, the price of securities and debt instruments and participation by other investors in financial markets may affect the value of CLOs and all other asset classes.

Disclosures

All investment performance information included in this document is historical. Past performance is not a guarantee of future results. Any taxrelated information contained in this document is for informational purposes only and should not be considered tax advice. You should consult a tax professional with any questions. These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise. C# 14889488A