What Gets Measured Gets Managed: Best Practices in Risk Management

January 05, 2023

By Matt Reilly, Managing Director, Yazeed Abu-Sa'a, Director, and Jeremy Lachtrupp, Director, Institutional Solutions

With the ever-present risk of market volatility, it is critical insurers understand the risks that exist across their business and within their investment portfolios. There are many ways to measure and manage risks in a portfolio, Conning has a range of methods to help insurers measure investment risk in isolation, view investment risk in the context of overall enterprise risk, and consider specific “objective” risks that get at the core of an insurer’s operations and goals.

Portfolio Risk

Analytics such as duration, convexity, and credit ratings provide a well-understood assessment of specific types of risks on a security or across a portfolio. However, they lack depth as they are point-in-time and focus on specific risks. They lack insight into risks that might not be priced in the current market and thus fall short in their ability to assess prospective future economic states and associated risk. For investors worried about risks looming in their portfolio, there are tools that can help measure those risks and provide insight on how to consider positioning the portfolio for a variety of other economic environments.

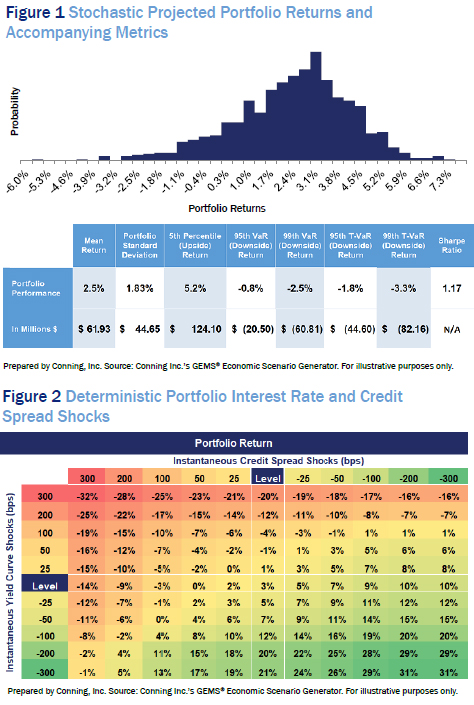

Conning utilizes its GEMS® economic scenario generator to create a set of 1,000 stochastic economic scenarios and accompanying investment returns to better understand the range of prospective portfolio outcomes. Figure 1 has a histogram and accompanying table of prospective returns for a portfolio over a one-year period. With this in hand, an insurer can understand estimates for average return over the time period across a range of scenarios along with the accompanying volatility. Other risk measures can be added, such as VaR or T-VaR, to better understand drawdown risk, or Sharpe ratio to better understand prospective returns on a risk-adjusted basis. This work can be extended across varying time frames to compare a variety of investment strategies.

Deterministic shocks are another tool to help investors understand how the portfolio could react across a range of scenarios. Figure 2 is a table of projected returns for a sample portfolio across a range of interest rate and credit spread shocks. With this type of tool insurers can understand what happens to their portfolios if spreads widen or tighten, if rates fall or increase, or any combination thereof to varying magnitudes.

Click below to continue reading Conning’s Viewpoint, “What Gets Measured Gets Managed: Best Practices in Risk Management."

Disclosure

Past performance is not a guarantee of future results.

These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.

©2023 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. ADVISE®, FIRM®, and GEMS® are registered trademarks in the U.S. of Conning, Inc. Copyright 1990-2023 Conning, Inc. All rights reserved. ADVISE®, FIRM®, and GEMS® are proprietary software published and owned by Conning, Inc.

C: 16208366