Alternative Paths: Alt Assets May Offer Insurers Greater Yields, Returns and Risk Management

August 20, 2021

By Richard L. Sega, FSA, MAAA, Global Chief Investment Strategist

For more than a decade, insurance companies have sought greater yields than the near-zero interest rates offered by traditional fixed-income strategies. Many have found opportunities in alternative strategies, or “alts.” Is this a road other insurers should consider?

There are many forms of alts spread across the investment landscape. Some fit the perception of alts as being further out on the risk curve, but several alts can help reduce portfolio risk. To decide if alts are an appropriate investment, it’s important for insurers to know their investment goals and what portfolio issue must be addressed. How much risk is the insurer comfortable with? And if an insurer ventures into new investment territory, does its staff have the asset management skills, knowledge of the regulatory framework, accounting skills and more to include alts in the portfolio successfully?

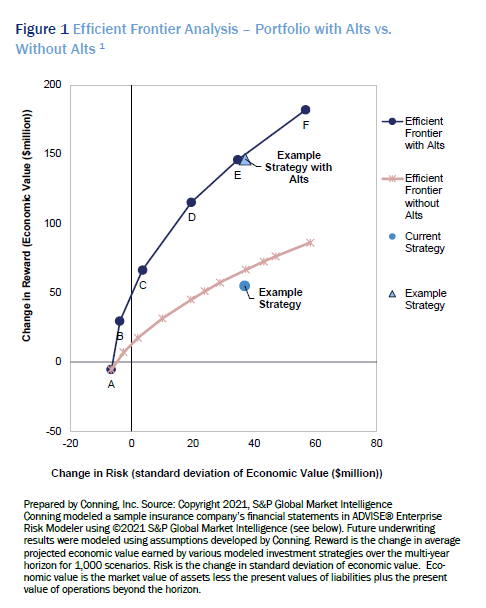

Conning believes alts may offer insurers a greater menu of investment choices to help further diversify a portfolio, generate greater yield and return, and improve downside protection. In Figure 1, an efficient frontier analysis shows the potential difference in the risk/return for a portfolio with alts vs a portfolio without alts, illustrating the opportunity to enhance economic value by considering the risk adjusted return benefits of incorporating alts into portfolios.

We also think that, as with any investment selection, an alt must align with an insurer’s investment strategy. However, if insurers can learn how to assess the array of suitable investment options, the education and experience gleaned in the process could pay greater dividends down the road.

Click below to continue reading Conning’s Viewpoint, “Alternative Paths: Alt Assets May Offer Insurers Greater Yields, Returns and Risk Management."

Disclosure

©2021 Conning, Inc. All rights reserved. The information herein is proprietary to Conning, and represents the opinion of Conning. No part of the information above may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system or translated into any language in any form by any means without the prior written permission of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice. The information contained herein is not guaranteed to be complete or accurate and Conning cannot be held liable for any errors in or any reliance upon this information. Any opinions contained herein are subject to change without notice. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Advisors, LLC and Global Evolution Holding ApS and its group of companies are all direct or indirect subsidiaries of Conning Holdings Limited (collectively “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd. a Taiwan-based company. ADVISE® is a registered trademark in the U.S. of Conning, Inc. Copyright 1990-2021 Conning, Inc. All rights reserved. C: 13370137