Investment Outlook 2024: Focus on Quality As a Mild Recession Looms

November 10, 2023

By Richard L. Sega, Global Chief Investment Strategist

Forecasting often seems like a painful and unrewarding exercise. The economic environment and sentiment can be upended at any time in any number of ways by unanticipated events. But as Louis Pasteur remarked, “Chance favors the prepared mind.”

Risk mitigation is critical for insurers’ operations and their portfolio management. Insurance industry portfolios are as varied as the lines of business they support, but they all rely on the benefits of a strong underlying economy. From the demand for insurance that fuels their growth and prosperity to the markets in which they invest, the economic outlook, the path forward for equities, and the level and direction of interest rates are pivotal to insurance companies’ successful risk mitigation.

What can we surmise about the future – and which strategies might help insurers navigate it?

A Recession in 2024?

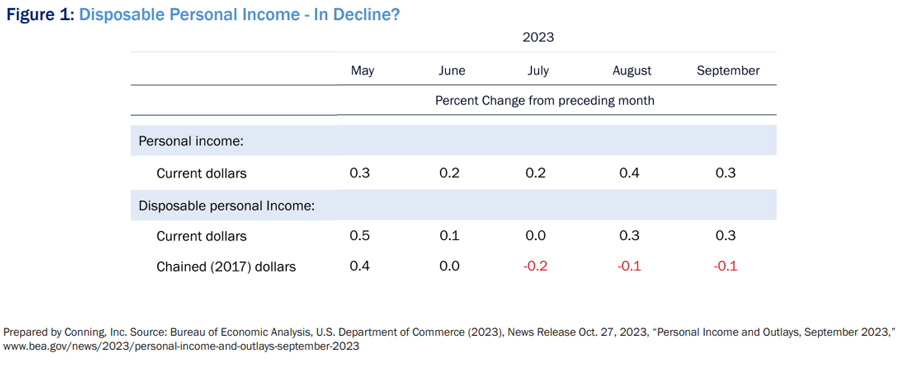

Through the third quarter of 2023, the U.S. economy proved quite resilient, helped by the consumer. There are signs that the U.S. consumer might be pulling back (see Figure 1) and that higher rates are beginning to affect at least the lower tier of income earners. We believe that sometime in the first half of 2024, the rolling recession finally will hit consumers more broadly.

To date though, it has been a Goldilocks economy with everything just about right - not too hot, not too cold - in labor markets, manufacturing, and housing. Stock market returns propped up by steady corporate earnings have supported surplus levels at many insurers. While total returns in bond markets have been nothing short of frightening, the higher interest rates available for newly issued bonds have allowed portfolio yields to rise and portfolio durations to extend to meet their liability targets.

Click below to continue reading Conning’s Viewpoint, “Investment Outlook 2024: Focus on Quality As a Mild Recession Looms."

Disclosure

©2023 Conning, Inc. This document and the software described within are copyrighted with all rights reserved. No part of this document may be distributed, reproduced, transcribed, transmitted, stored in an electronic retrieval system, or translated into any language in any form by any means without the prior written permission of Conning. Conning does not make any warranties, express or implied, in this document. In no event shall Conning be liable for damages of any kind arising out of the use of this document or the information contained within it. This document is not intended to be complete, and we do not guarantee its accuracy. Any opinion expressed in this document is subject to change at any time without notice. This opinion is published by Conning, Inc., and represents the opinion of Conning. This publication is intended only to inform readers about general developments of interest and does not constitute investment advice or a solicitation. Conning, Inc., Goodwin Capital Advisers, Inc., Conning Investment Products, Inc., a FINRA-registered broker-dealer, Conning Asset Management Limited, Conning Asia Pacific Limited, Octagon Credit Investors, LLC, Global Evolution Holding ApS and its group of companies, and Pearlmark Real Estate, L.L.C. are all direct or indirect subsidiaries of Conning Holdings Limited (collectively, “Conning”) which is one of the family of companies owned by Cathay Financial Holding Co., Ltd., a Taiwan-based company. Conning has investment centers in Asia, Europe and North America. C: 17582412

These materials contain forward-looking statements. Investors should not place undue reliance on forward-looking statements. Actual results could differ materially from those referenced in forward-looking statements for many reasons. Forward-looking statements are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any forward-looking statements will not materialize or will vary significantly from actual results. Variations of assumptions and results may be material. Without limiting the generality of the foregoing, the inclusion of forward-looking statements herein should not be regarded as a representation by the Investment Manager or any of their respective affiliates or any other person of the results that will actually be achieved as presented. None of the foregoing persons has any obligation to update or otherwise revise any forward-looking statements, including any revision to reflect changes in any circumstances arising after the date hereof relating to any assumptions or otherwise.